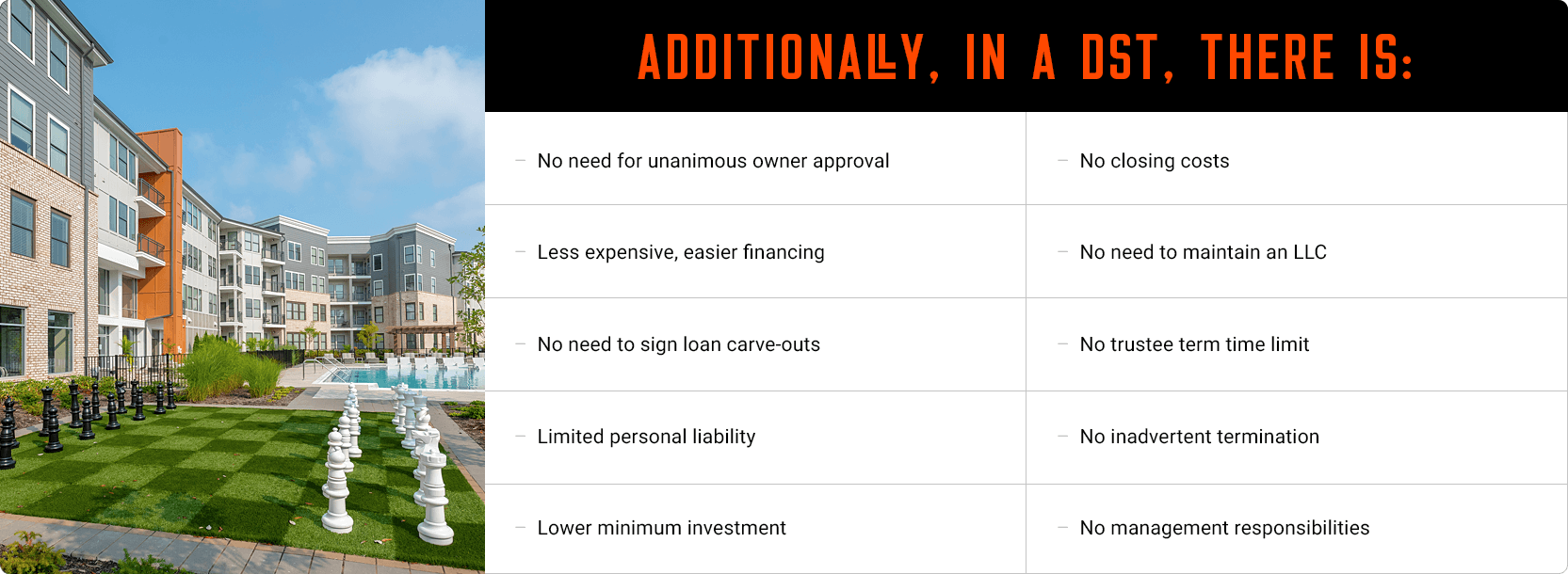

Rental income and tax benefits on an investment property can generate considerable wealth for many landlords – but dealing with the hassle of tenant and property management has deterred some from investing in real estate. However, a Delaware Statutory Trust (DST) is a separate legal entity created as a trust under Delaware statutory law, which permits a very flexible approach to the design and operation of the entity. Investors in a Delaware Statutory Trust own a pro rata interest in the trust and have the right to receive distributions from the operation of the trust, either from rental income, or from the eventual sale of the property.

As a co-ownership system, a DST allows investors to benefit from property investment gains without being responsible for management. With a Delaware Statutory Trust 1031 exchange, the trustee takes on the legal title and management responsibilities, while the investors serve as beneficiaries with the equitable title.

Through co-ownership, it’s possible to fractionally invest in larger properties, such as medical offices, industrial properties or multifamily apartment communities that might be too costly to purchase in full. A DST expands the options investors have for replacement properties to meet 1031 criteria, allowing for more diversification. Finding eligible properties may also be less time-consuming because investors have more options for acquiring one or more properties.

To get a DST 1031 property, an investor must work with a Qualified Intermediary (QI) to handle the exchange. The stipulation is that a third party not affiliated with the seller or buyer must hold and transfer the money to complete the exchange. The investor cannot directly receive the money from the first property sale.

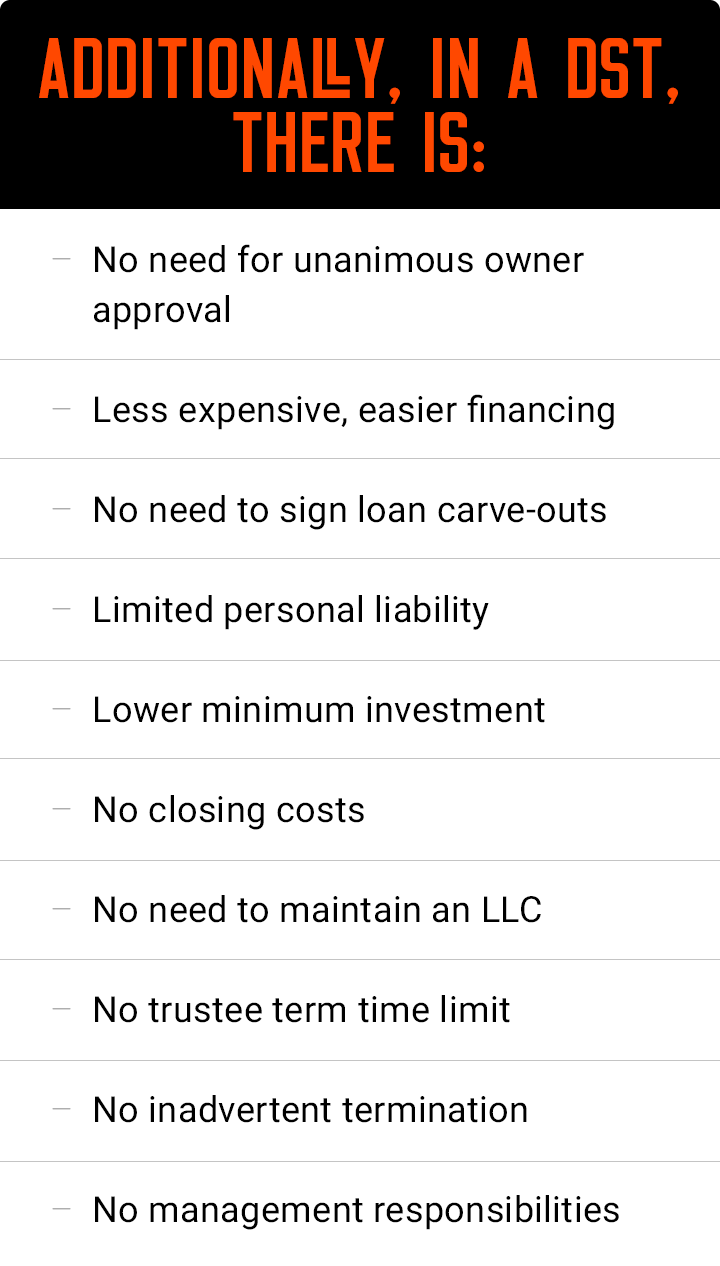

The arrangement holds significant and multiple benefits. Many investors choose a DST because it offers potential returns on real estate holdings without many of the complications of property management. For the purposes of a tax-deferred 1031 exchange, the purchase of a beneficial interest in a Delaware Statutory Trust is treated as a direct interest in real estate, thus satisfying that requirement of IRS Revenue Ruling 2004-86. A DST can also be an attractive investment vehicle for investors who are not conducting a 1031 exchange.